Learn how to achieve financial freedom in 2025 with smart investing, mindset shifts, and proven wealth strategies from expert money mentors. Achieving financial freedom in 2025 requires dedication and informed decisions.

🏆 How to Achieve Financial Freedom in 2025: A Proven Guide to Smart Investing, Wealth Building & Personal Finance

Over 50% of people set New Year’s resolutions around money — but most don’t follow through. If you’re serious about achieving financial freedom in 2025, this article is your roadmap. Based on top insights from money experts, this post simplifies everything from investing basics to tax strategies, mindset, and compound interest.

Many are on a journey towards financial freedom in 2025, driven by the desire to create a stable financial future.

Understanding these pitfalls is crucial for achieving financial freedom in 2025.

🧠 Why Most People Stay Broke (And How to Escape It)

The most expensive thing you’re paying for?

The information you don’t know.

Banks love broke people. You pay high-interest debt, taxes, and buy things to impress others — while you could be building wealth instead. Your goal?

📌 Become an owner, not just an earner.

Striving for financial freedom in 2025 is about changing your relationship with money.

Start planning your steps toward financial freedom in 2025 today.

📈 Investing for Beginners: The Easiest Way to Start

If you’ve never invested, don’t worry. Most people assume investing is only for the rich — it’s not.

Understanding these fundamentals is essential for achieving financial freedom in 2025.

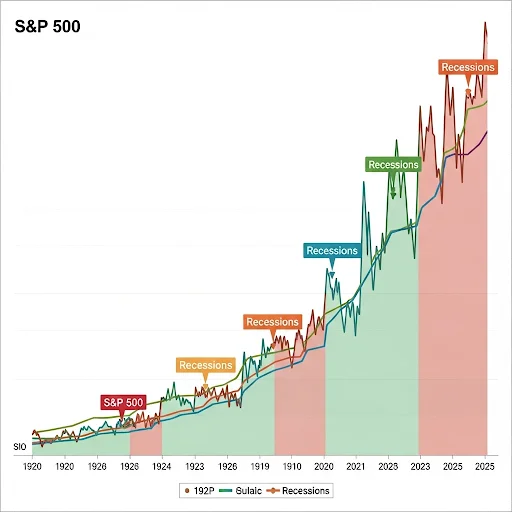

✔️ What’s the S&P 500?

The S&P 500 is a stock market index that tracks the performance of the 500 biggest companies in the U.S. Historically, it returns 10–11% annually, around 7% after inflation.

✔️ What’s a Target Date Fund?

A Target Date Fund is the easiest investment tool for beginners. It adjusts automatically based on your age:

- If you plan to retire in 2050 → choose a ‘2050 Target Date Fund’

- Available via Vanguard, Fidelity, Schwab, and others

Just deposit money every month. That’s it.

📌 Pro Tip: Don’t check it daily. Let it cook — like a turkey on Thanksgiving.

💸 The Power of Compound Interest

$5,000 invested yearly at 7% over 40 years becomes over $1 million.

Start earlier? Retire richer. The math is simple:

📊 Why Index Funds Beat Stock Picking

- ✅ Diversified: Own 100s of companies

- ✅ Low maintenance: Set it and forget it

- ✅ Proven returns: Beat most day traders and even pros

Consider how each choice you make today can impact your financial freedom in 2025.

Most successful investors aren’t genius stock pickers.

They’re long-term thinkers with endurance.

The S&P 500 is an excellent option for those pursuing financial freedom in 2025.

🧾 Automate Your Finances in 3 Steps

“The goal is not to get rich fast. The goal is to get rich for sure.” — Ramit Sethi

Step 1: Your salary goes into a checking account

Step 2: Automatically split into:

- Emergency savings

- Investment fund (index funds/target date fund)

- Guilt-free spending

- Credit card autopay

With the right mindset, anyone can achieve financial freedom in 2025.

Step 3: Don’t touch it. Let it grow.

💡 How the Wealthy Avoid Taxes (Legally)

Rich people don’t pay high taxes — because they own assets, not just earn salary.

Strategies They Use:

- Borrow against appreciating stocks (no taxes on loans)

- Move to low-tax states (e.g., Florida, Texas)

- Invest in QSB stocks — first $10M gains are tax-free

- Use trusts and estate planning to pass down wealth

🧠 The Mindset Shift: Owner > Earner

Don’t sell your time. Buy or build assets.

- Earners: Pay the most taxes, work for money

- Owners: Get rich through equity, businesses, and investment returns

Many strategies can help you reach financial freedom in 2025.

Example:

- Employee earns $100K salary → taxed 40%

- Business owner builds value → taxed 15% or less

These methods can greatly affect your financial freedom in 2025.

💥 Real Stories: From Janitor to Millionaire

Meet Ronald Read, a janitor who left behind $8 million by investing small amounts consistently in index funds for decades. The secret? Patience and never selling.

Manage your investments wisely to ensure financial freedom in 2025.

🧠 The Psychology of Wealth: Seasons of Sacrifice

In your 20s or broke? You have to choose:

Suffer now or suffer forever.

Stop trying to impress others. Live lean, focus on growth, and delay gratification. Confidence comes from progress, not possessions.

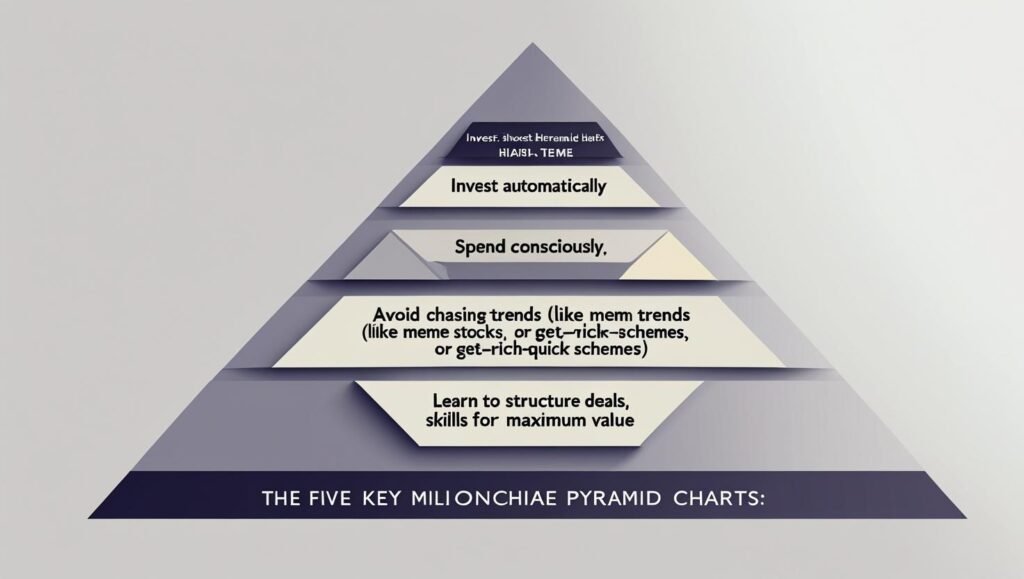

🔑 Key Habits of Millionaires

- Invest automatically

- Spend consciously

- Don’t chase trends (like meme stocks or get-rich-quick schemes)

- Learn how to structure deals

- Leverage your unique skills where they’re most valuable

💬 “Leverage” Is the Secret to Million-Dollar Wealth

Leverage = Doing less and earning more

Types of leverage:

- Labor – you doing the work

- People – others do it for you

- Capital – money works for you

- Media – one message reaches millions

- Code – scalable digital tools

Use more leverage, and smarter leverage, to increase returns.

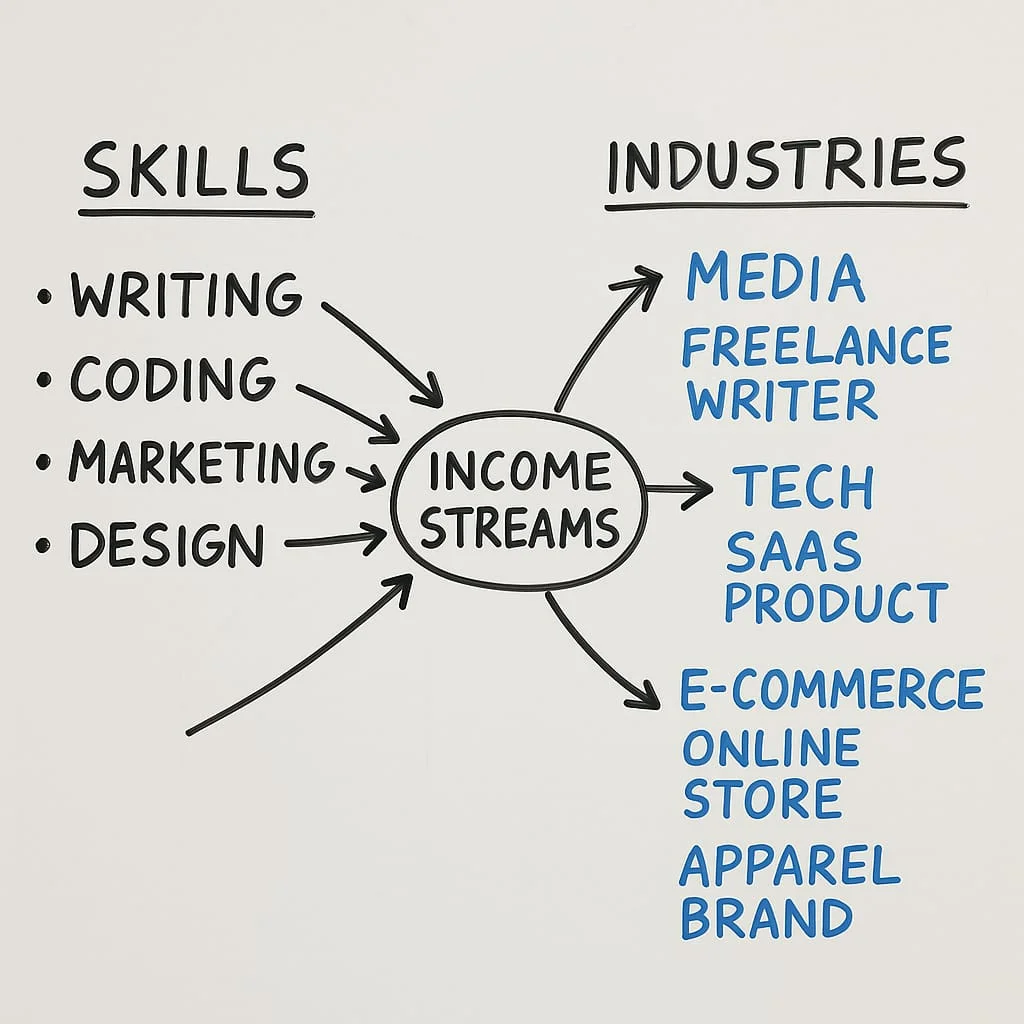

🧠 Expert Exercise: Skills × Industry = Big Money

Step 1: List your best skills

Step 2: Match them to high-profit industries

Step 3: Find a problem and offer your solution

Step 4: Ask for a % of revenue or equity — not just a salary

🏠 Should You Buy a House to Build Wealth?

Short answer: No.

Buying a home is a lifestyle decision, not a wealth strategy. Historically, home prices have only matched inflation.

- Renting ≠ throwing money away

- Investing the down payment is often smarter

- Keep mobile, invest elsewhere

🔐 Blockchain, Crypto & The New Internet of Value

Crypto isn’t just about money — it’s about truth and access. Anyone with $10 can invest in Ethereum and benefit as use cases grow (like gaming, decentralized apps, etc.).

It’s the first global, borderless asset accessible to all.

💡 Final Words: Invest in What You Control

Whether you’re in a call center, freelancing, or running a startup — the path to wealth begins by:

- Controlling spending

- Automating savings

- Investing wisely

- Learning consistently

- Thinking long-term

You don’t need to be rich to start investing.

You need to start investing to get rich.

🔑 Summary: Your Financial Freedom Toolkit for 2025

| Action Item | Why It Matters |

|---|---|

| Open index fund | Easy, diversified, proven returns |

| Automate investments | Remove emotion + build habit |

| Learn tax strategies | Keep more of your income |

| Focus on ownership | Scale wealth with leverage |

| Delay gratification | Short-term pain, lifetime gain |

📢 Ready to Level Up?

👉 Save this post

👉 Share it with a friend

👉 Create your own whiteboard of skills × money ideas

👉 And commit to your financial freedom in 2025

Checkout our previous post on Google AI Tools (Latest):

💬 Have questions or want help building your investment plan? Drop a comment or tag us on X.com with your Skills × Money chart!

Invest in what aligns with your goal of financial freedom in 2025.

Explore opportunities that enhance your financial freedom in 2025.

Crypto can be part of your strategy for financial freedom in 2025.

Your journey towards financial freedom in 2025 will require clear action steps.

Remember, financial freedom in 2025 is achievable with commitment and effort.

Discover more from blogbooze

Subscribe to get the latest posts sent to your email.

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my trouble You are amazing Thanks